Discover our Microsoft Dynamics capabilities in Canada

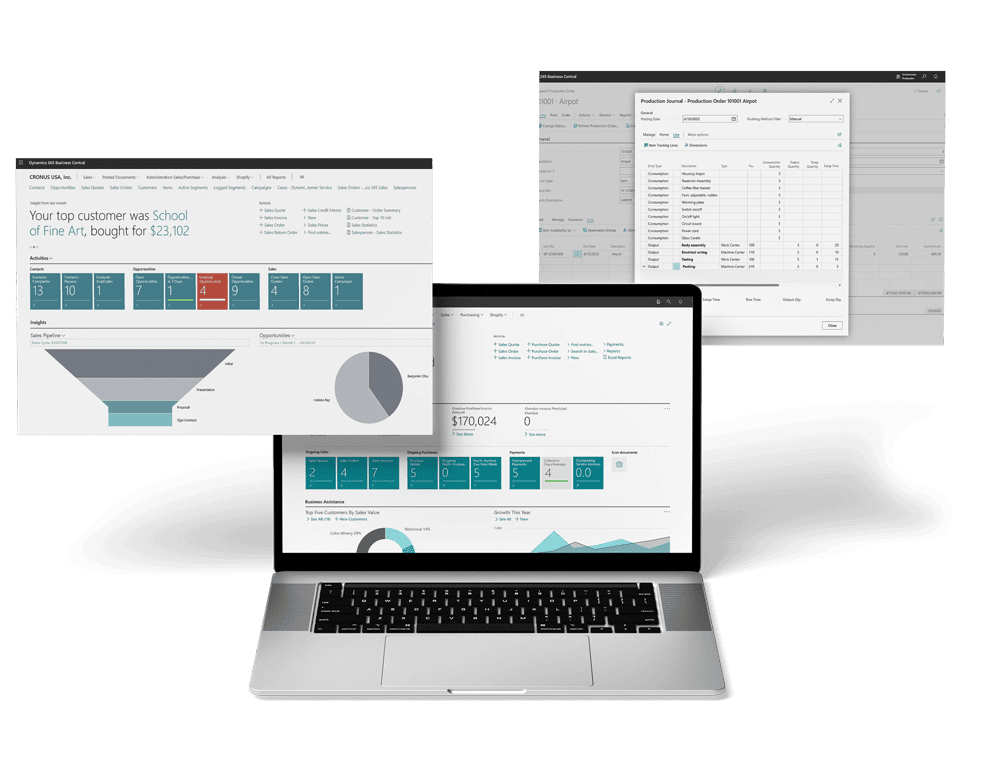

Our local and dedicated resources specialize in Microsoft Dynamics 365 solutions and work according to a methodology aligned with the latest release of Dynamics 365 for Finance & Supply Chain

Management, Customer Engagement, and Business Central.

27

Consultant

99

Projects done

Services we offer

Localizations packages

Dynamics 365 technologies

Common implementation challenges in Canada

Strict Data Sovereignty and Privacy Laws

Bilingual Language Requirements

Diverse Taxation and Compliance Standards

How exactly can Pipol help your business?

Experience a transformative journey with Pipol, where we unlock unparalleled value while minimizing risk. From expedited implementation to localized expertise, our comprehensive approach ensures your ERP project's success.

Local presence & knowledge

Leverage our intimate understanding of local business landscapes to drive tailored solutions that resonate with your region's unique nuances.

Faster implemenation

Accelerate your digital transformation with our efficient processes and streamlined methodologies, getting your ERP solution up and running in record time.

Minimised risk

Rely on our expertise to mitigate potential pitfalls, safeguarding your project against costly setbacks and ensuring a smooth ERP implementation journey.

Higher success rate

Trust in our proven track record and industry-leading expertise to maximize the likelihood of a successful ERP implementation, delivering tangible results for your business.

Let’s set you up with the right partner

Working with the right partner is essential for your project's success. This is why we want to speak to you and understand your business needs and goals before assigning a partner.

Get in touch

Send us an email

Let us know what your challenges are all about. We are here to help.