Finance companies

The Finance industry operates in a highly complex and regulated global environment, with institutions managing multiple currencies, regulations, and economic landscapes across countries. A robust Enterprise Resource Planning (ERP) system is crucial for financial institutions and enterprises operating across borders. International ERP systems help financial organizations manage everything from compliance and risk management to multi-currency transactions and real-time reporting.

Key challenges in the industry

Multi-currency and multi-jurisdictional financial management

Handling transactions and accounting across multiple currencies, tax systems, and regulatory environments while maintaining accurate reporting and financial integrity.

Regulatory compliance across borders

Navigating the complex regulatory requirements of different countries, including anti-money laundering (AML), international accounting standards (IFRS/GAAP), and local banking regulations.

Risk management in a volatile global market

Monitoring and mitigating financial risks, including currency fluctuations, interest rate changes, and regional economic instability.

Real-time financial reporting and transparency

Providing accurate and timely financial reports for stakeholders in multiple countries while ensuring transparency and adherence to global reporting standards.

Cost control and operational efficiency

Managing operational costs and improving efficiency across global operations while balancing regional variations in costs, taxes, and economic conditions.

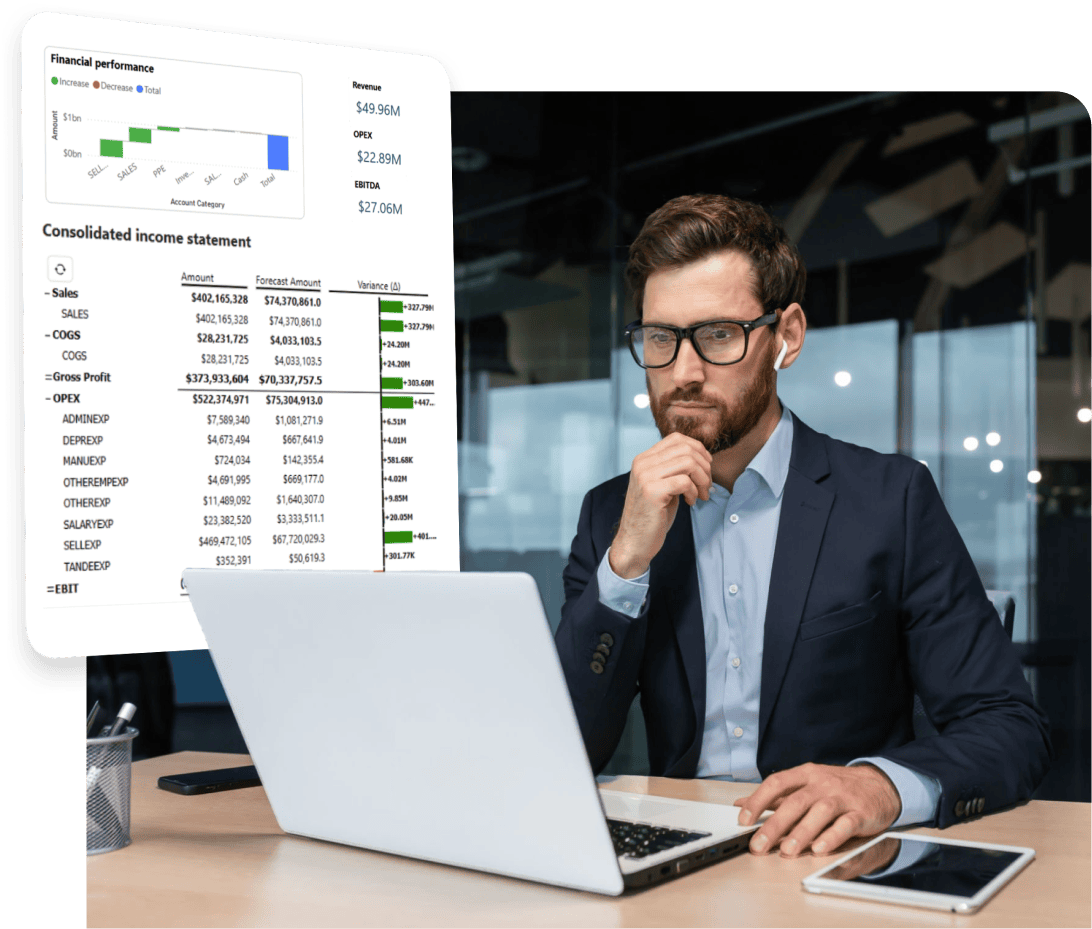

Enhancing global financial operations with international ERP

Implementing an international ERP system is essential for financial institutions looking to optimize global operations. From managing multi-currency transactions and ensuring compliance with diverse regulatory frameworks to mitigating financial risks and improving operational efficiency, a tailored ERP solution provides the tools necessary for success in the finance industry.

An ERP system enables financial institutions to maintain profitability and manage risks effectively by addressing industry-specific challenges such as regulatory compliance, financial transparency, and cost management. With the right ERP system in place, finance organizations can ensure seamless global operations, improve decision-making through real-time data, and meet the evolving demands of the global market.

Tailored solutions

- Multi-currency financial management: A global ERP system provides tools for managing multi-currency transactions, currency conversion, and exchange rate fluctuations. The system ensures accurate financial records and facilitates seamless transactions across different currencies, reducing the risk of errors in exchange rates and improving overall financial visibility.

- Regulatory compliance management: Financial institutions can manage compliance with local and international regulations, such as IFRS, GAAP, and AML requirements. ERP systems offer built-in compliance features that automate reporting, monitor regulatory changes, and provide audit trails for regulatory authorities.

- Risk mManagement and financial controls: ERP systems provide advanced tools for monitoring financial risks, including credit risk, liquidity risk, and currency risk. These systems offer real-time data and predictive analytics to help finance professionals mitigate risks and adjust to market volatility.

- Real-time financial reporting: Global ERP systems offer real-time financial reporting and analytics, allowing financial institutions to produce up-to-date financial statements, balance sheets, and cash flow reports across multiple jurisdictions. This improves transparency and ensures compliance with reporting standards in all regions of operation.

- Cost control and operational efficiency: The ERP system provides tools for managing operational costs, including real-time budget tracking, variance analysis, and multi-region cost allocation. These features help financial institutions streamline operations and maintain profitability in different economic environments.

Key factors for successful ERP implementation

- Comprehensive multi-currency management: Ensure the ERP system offers comprehensive tools for managing multi-currency transactions, including real-time currency conversion and exchange rate management. The system should provide accurate and timely information to support international financial operations.

- Regulatory compliance and reporting: The ERP system should include built-in compliance management for international and local regulations. Automated reporting tools, audit trails, and real-time updates on regulatory changes are essential for ensuring that your institution remains compliant across all jurisdictions.

- Risk management and financial controls: Look for an ERP system that provides robust risk management tools, including real-time credit, liquidity, and market risk monitoring. The system should offer predictive analytics and financial controls to help mitigate risk in a volatile global market.

- Real-time reporting and analytics: A global ERP system must offer real-time reporting capabilities, enabling your organization to generate financial reports that meet international standards. The ability to produce accurate financial statements, cash flow reports, and balance sheets in real time is crucial for transparency and stakeholder communication.

- Cost control and budget management: The ERP system should offer tools for tracking operational costs across regions, including real-time budget tracking, cost allocation, and variance analysis. This helps financial institutions control costs, improve operational efficiency, and maintain profitability across multiple economic environments.

Get in touch

Send us an email

Let us know what your challenges are all about. We are here to help.

Customer Success Stories

Read about how we helped other companies in your industry

High quality international roll-out for Mundipharma Switzerland

Pipol is pleased to announce that this week our customer Mundipharma Switzerland, together...

3 min read

Rentokil Initial Standardizes Global Reporting Processes with Microsoft Dynamics

“We can consistently use the region’s standard reports and add-on tools. Thanks to...

4 min read

Roland Europe Group Streamlined their Warehouse and Financial Operations with Microsoft Dynamics 365

Roland Europe Group, a leading player in the musical instruments and professional audio...

4 min read